pacman::p_load(olsrr, corrplot, ggpubr, sf, spdep, GWmodel, tmap, tidyverse, gtsummary)7A: Calibrating Hedonic Pricing Model for Private Highrise Property with GWR Method

In this exercise, we will learn to build hedonic pricing models for private high-rise property using Geographically Weighted Regression (GWR) methods to account for non-stationary variables.

1 Exercise 7A Reference

2 Overview

In this exercise, we will learn to build hedonic pricing models for private high-rise property using Geographically Weighted Regression (GWR) methods to account for non-stationary variables.

Geographically weighted regression (GWR) is a spatial statistical technique that takes non-stationary variables into consideration (e.g., climate; demographic factors; physical environment characteristics) and models the local relationships between these independent variables and an outcome of interest (also known as dependent variable).

In this exercise, The dependent variable is the resale prices of condominium in 2015. The independent variables are divided into either structural and locational.

We will be using the GWmodel package. It provides a collection of localised spatial statistical methods, namely: GW summary statistics, GW principal components analysis, GW discriminant analysis and various forms of GW regression; some of which are provided in basic and robust (outlier resistant) forms. Commonly, outputs or parameters of the GWmodel are mapped to provide a useful exploratory tool, which can often precede (and direct) a more traditional or sophisticated statistical analysis.

3 Learning Outcome

- Understand the basics of geographically weighted regression (GWR).

- Build and evaluate hedonic pricing models using GWR.

- Convert geospatial and aspatial data into appropriate formats for analysis.

- Perform exploratory data analysis (EDA) using statistical graphics.

- Visualize the model outputs and spatial patterns using various R packages.

- Assess spatial autocorrelation and other statistical properties of model residuals.

- Compare and interpret fixed and adaptive bandwidth GWR models.

4 The Data

The following 2 datasets will be used in this study:

| Data Set | Description | Format |

|---|---|---|

| MP14_SUBZONE_WEB_PL | URA Master Plan 2014’s planning subzone boundaries represented as polygon features. | ESRI Shapefile |

| condo_resale_2015.csv | Data on condominium resale prices in 2015, including structural and locational attributes. | CSV |

5 Installing and Launching the R Packages

The following R packages will be used in this exercise:

| Package | Purpose | Use Case in Exercise |

|---|---|---|

| sf | Manages, processes, and manipulates vector-based geospatial data. | Handling and converting geospatial data such as the URA Master Plan boundaries. |

| GWmodel | Calibrates geographically weighted models for local spatial analysis. | Building hedonic pricing models using fixed and adaptive bandwidth GWR methods. |

| olsrr | Performs diagnostics and builds better multiple linear regression models. | Testing for multicollinearity, normality, and linearity of the regression model. |

| corrplot | Provides visual tools to explore data correlation matrices. | Visualizing relationships between independent variables in the dataset. |

| tmap | Creates static and interactive thematic maps using cartographic quality elements. | Visualizing the geospatial distribution of condominium resale prices and other model outputs. |

| tidyverse | A collection of packages for data science tasks such as data manipulation, visualization, and modeling. | Importing CSV files, wrangling data, and performing data transformations and visualizations. |

| ggpubr | Enhances ‘ggplot2’ for easier ‘publication-ready’ plots. | Creating small multiple histograms and scatterplots for exploratory data analysis. |

To install and load these packages, use the following code:

6 Geospatial Data Wrangling

6.1 Importing Geospatial Data

To import MP_SUBZONE_WEB_PL shapefile:

mpsz = st_read(dsn = "data/geospatial", layer = "MP14_SUBZONE_WEB_PL")Reading layer `MP14_SUBZONE_WEB_PL' from data source

`/Users/walter/code/isss626/isss626-gaa/Hands-on_Ex/Hands-on_Ex07/data/geospatial'

using driver `ESRI Shapefile'

Simple feature collection with 323 features and 15 fields

Geometry type: MULTIPOLYGON

Dimension: XY

Bounding box: xmin: 2667.538 ymin: 15748.72 xmax: 56396.44 ymax: 50256.33

Projected CRS: SVY21The output above shows that the R object used to contain the imported MP14_SUBZONE_WEB_PL shapefile is called mpsz and it is a simple feature object. The geometry type is multipolygon. It is also important to note that mpsz simple feature object does not have EPSG information.

6.2 Updating CRS Information

The code below updates the newly imported mpsz with the correct ESPG code (i.e. 3414)

mpsz_svy21 <- st_transform(mpsz, 3414)

st_crs(mpsz_svy21)Coordinate Reference System:

User input: EPSG:3414

wkt:

PROJCRS["SVY21 / Singapore TM",

BASEGEOGCRS["SVY21",

DATUM["SVY21",

ELLIPSOID["WGS 84",6378137,298.257223563,

LENGTHUNIT["metre",1]]],

PRIMEM["Greenwich",0,

ANGLEUNIT["degree",0.0174532925199433]],

ID["EPSG",4757]],

CONVERSION["Singapore Transverse Mercator",

METHOD["Transverse Mercator",

ID["EPSG",9807]],

PARAMETER["Latitude of natural origin",1.36666666666667,

ANGLEUNIT["degree",0.0174532925199433],

ID["EPSG",8801]],

PARAMETER["Longitude of natural origin",103.833333333333,

ANGLEUNIT["degree",0.0174532925199433],

ID["EPSG",8802]],

PARAMETER["Scale factor at natural origin",1,

SCALEUNIT["unity",1],

ID["EPSG",8805]],

PARAMETER["False easting",28001.642,

LENGTHUNIT["metre",1],

ID["EPSG",8806]],

PARAMETER["False northing",38744.572,

LENGTHUNIT["metre",1],

ID["EPSG",8807]]],

CS[Cartesian,2],

AXIS["northing (N)",north,

ORDER[1],

LENGTHUNIT["metre",1]],

AXIS["easting (E)",east,

ORDER[2],

LENGTHUNIT["metre",1]],

USAGE[

SCOPE["Cadastre, engineering survey, topographic mapping."],

AREA["Singapore - onshore and offshore."],

BBOX[1.13,103.59,1.47,104.07]],

ID["EPSG",3414]]Notice that the EPSG: is indicated as 3414 now.

6.3 Revealing the Extent of mpsz_svy21

To reveal the extent of mpsz_svy21:

st_bbox(mpsz_svy21) #view extent xmin ymin xmax ymax

2667.538 15748.721 56396.440 50256.334 7 Aspatial Data Wrangling

7.1 Importing Aspatial Data

The condo_resale_2015 is in csv file format. The codes

chunk below uses read_csv() function of

readr package to import

condo_resale_2015 into R as a tibble data frame called

condo_resale.

condo_resale = read_csv("data/aspatial/Condo_resale_2015.csv")

glimpse(condo_resale)Rows: 1,436

Columns: 23

$ LATITUDE <dbl> 1.287145, 1.328698, 1.313727, 1.308563, 1.321437,…

$ LONGITUDE <dbl> 103.7802, 103.8123, 103.7971, 103.8247, 103.9505,…

$ POSTCODE <dbl> 118635, 288420, 267833, 258380, 467169, 466472, 3…

$ SELLING_PRICE <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1320…

$ AREA_SQM <dbl> 309, 290, 248, 127, 145, 139, 218, 141, 165, 168,…

$ AGE <dbl> 30, 32, 33, 7, 28, 22, 24, 24, 27, 31, 17, 22, 6,…

$ PROX_CBD <dbl> 7.941259, 6.609797, 6.898000, 4.038861, 11.783402…

$ PROX_CHILDCARE <dbl> 0.16597932, 0.28027246, 0.42922669, 0.39473543, 0…

$ PROX_ELDERLYCARE <dbl> 2.5198118, 1.9333338, 0.5021395, 1.9910316, 1.121…

$ PROX_URA_GROWTH_AREA <dbl> 6.618741, 7.505109, 6.463887, 4.906512, 6.410632,…

$ PROX_HAWKER_MARKET <dbl> 1.76542207, 0.54507614, 0.37789301, 1.68259969, 0…

$ PROX_KINDERGARTEN <dbl> 0.05835552, 0.61592412, 0.14120309, 0.38200076, 0…

$ PROX_MRT <dbl> 0.5607188, 0.6584461, 0.3053433, 0.6910183, 0.528…

$ PROX_PARK <dbl> 1.1710446, 0.1992269, 0.2779886, 0.9832843, 0.116…

$ PROX_PRIMARY_SCH <dbl> 1.6340256, 0.9747834, 1.4715016, 1.4546324, 0.709…

$ PROX_TOP_PRIMARY_SCH <dbl> 3.3273195, 0.9747834, 1.4715016, 2.3006394, 0.709…

$ PROX_SHOPPING_MALL <dbl> 2.2102717, 2.9374279, 1.2256850, 0.3525671, 1.307…

$ PROX_SUPERMARKET <dbl> 0.9103958, 0.5900617, 0.4135583, 0.4162219, 0.581…

$ PROX_BUS_STOP <dbl> 0.10336166, 0.28673408, 0.28504777, 0.29872340, 0…

$ NO_Of_UNITS <dbl> 18, 20, 27, 30, 30, 31, 32, 32, 32, 32, 34, 34, 3…

$ FAMILY_FRIENDLY <dbl> 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 0, 0, 0, 0, 0…

$ FREEHOLD <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 1, 1, 1…

$ LEASEHOLD_99YR <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…To display summary statistics of condo_resale:

summary(condo_resale) LATITUDE LONGITUDE POSTCODE SELLING_PRICE

Min. :1.240 Min. :103.7 Min. : 18965 Min. : 540000

1st Qu.:1.309 1st Qu.:103.8 1st Qu.:259849 1st Qu.: 1100000

Median :1.328 Median :103.8 Median :469298 Median : 1383222

Mean :1.334 Mean :103.8 Mean :440439 Mean : 1751211

3rd Qu.:1.357 3rd Qu.:103.9 3rd Qu.:589486 3rd Qu.: 1950000

Max. :1.454 Max. :104.0 Max. :828833 Max. :18000000

AREA_SQM AGE PROX_CBD PROX_CHILDCARE

Min. : 34.0 Min. : 0.00 Min. : 0.3869 Min. :0.004927

1st Qu.:103.0 1st Qu.: 5.00 1st Qu.: 5.5574 1st Qu.:0.174481

Median :121.0 Median :11.00 Median : 9.3567 Median :0.258135

Mean :136.5 Mean :12.14 Mean : 9.3254 Mean :0.326313

3rd Qu.:156.0 3rd Qu.:18.00 3rd Qu.:12.6661 3rd Qu.:0.368293

Max. :619.0 Max. :37.00 Max. :19.1804 Max. :3.465726

PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_HAWKER_MARKET PROX_KINDERGARTEN

Min. :0.05451 Min. :0.2145 Min. :0.05182 Min. :0.004927

1st Qu.:0.61254 1st Qu.:3.1643 1st Qu.:0.55245 1st Qu.:0.276345

Median :0.94179 Median :4.6186 Median :0.90842 Median :0.413385

Mean :1.05351 Mean :4.5981 Mean :1.27987 Mean :0.458903

3rd Qu.:1.35122 3rd Qu.:5.7550 3rd Qu.:1.68578 3rd Qu.:0.578474

Max. :3.94916 Max. :9.1554 Max. :5.37435 Max. :2.229045

PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_TOP_PRIMARY_SCH

Min. :0.05278 Min. :0.02906 Min. :0.07711 Min. :0.07711

1st Qu.:0.34646 1st Qu.:0.26211 1st Qu.:0.44024 1st Qu.:1.34451

Median :0.57430 Median :0.39926 Median :0.63505 Median :1.88213

Mean :0.67316 Mean :0.49802 Mean :0.75471 Mean :2.27347

3rd Qu.:0.84844 3rd Qu.:0.65592 3rd Qu.:0.95104 3rd Qu.:2.90954

Max. :3.48037 Max. :2.16105 Max. :3.92899 Max. :6.74819

PROX_SHOPPING_MALL PROX_SUPERMARKET PROX_BUS_STOP NO_Of_UNITS

Min. :0.0000 Min. :0.0000 Min. :0.001595 Min. : 18.0

1st Qu.:0.5258 1st Qu.:0.3695 1st Qu.:0.098356 1st Qu.: 188.8

Median :0.9357 Median :0.5687 Median :0.151710 Median : 360.0

Mean :1.0455 Mean :0.6141 Mean :0.193974 Mean : 409.2

3rd Qu.:1.3994 3rd Qu.:0.7862 3rd Qu.:0.220466 3rd Qu.: 590.0

Max. :3.4774 Max. :2.2441 Max. :2.476639 Max. :1703.0

FAMILY_FRIENDLY FREEHOLD LEASEHOLD_99YR

Min. :0.0000 Min. :0.0000 Min. :0.0000

1st Qu.:0.0000 1st Qu.:0.0000 1st Qu.:0.0000

Median :0.0000 Median :0.0000 Median :0.0000

Mean :0.4868 Mean :0.4227 Mean :0.4882

3rd Qu.:1.0000 3rd Qu.:1.0000 3rd Qu.:1.0000

Max. :1.0000 Max. :1.0000 Max. :1.0000 7.2 Converting an Aspatial Data Frame to an sf Object

In this step, we will:

-

Use the

st_as_sf()function from the sf package to convert the aspatial data frame into a spatial (sf) object. -

Apply

st_transform()to reproject the coordinates from the WGS 84 coordinate system (CRS: 4326) to SVY21 (CRS: 3414), commonly used in Singapore.

condo_resale.sf <- st_as_sf(condo_resale,

coords = c("LONGITUDE", "LATITUDE"),

crs = 4326) %>%

st_transform(crs = 3414)

head(condo_resale.sf)Simple feature collection with 6 features and 21 fields

Geometry type: POINT

Dimension: XY

Bounding box: xmin: 22085.12 ymin: 29951.54 xmax: 41042.56 ymax: 34546.2

Projected CRS: SVY21 / Singapore TM

# A tibble: 6 × 22

POSTCODE SELLING_PRICE AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 118635 3000000 309 30 7.94 0.166 2.52

2 288420 3880000 290 32 6.61 0.280 1.93

3 267833 3325000 248 33 6.90 0.429 0.502

4 258380 4250000 127 7 4.04 0.395 1.99

5 467169 1400000 145 28 11.8 0.119 1.12

6 466472 1320000 139 22 10.3 0.125 0.789

# ℹ 15 more variables: PROX_URA_GROWTH_AREA <dbl>, PROX_HAWKER_MARKET <dbl>,

# PROX_KINDERGARTEN <dbl>, PROX_MRT <dbl>, PROX_PARK <dbl>,

# PROX_PRIMARY_SCH <dbl>, PROX_TOP_PRIMARY_SCH <dbl>,

# PROX_SHOPPING_MALL <dbl>, PROX_SUPERMARKET <dbl>, PROX_BUS_STOP <dbl>,

# NO_Of_UNITS <dbl>, FAMILY_FRIENDLY <dbl>, FREEHOLD <dbl>,

# LEASEHOLD_99YR <dbl>, geometry <POINT [m]>- The resulting output is a point-based feature data frame.

8 Exploratory Data Analysis

In the section, we will use statistical graphics functions of

ggplot2 package to perform EDA.

8.1 EDA using Statistical Graphics

8.2 6.1.1 Plot Distribution

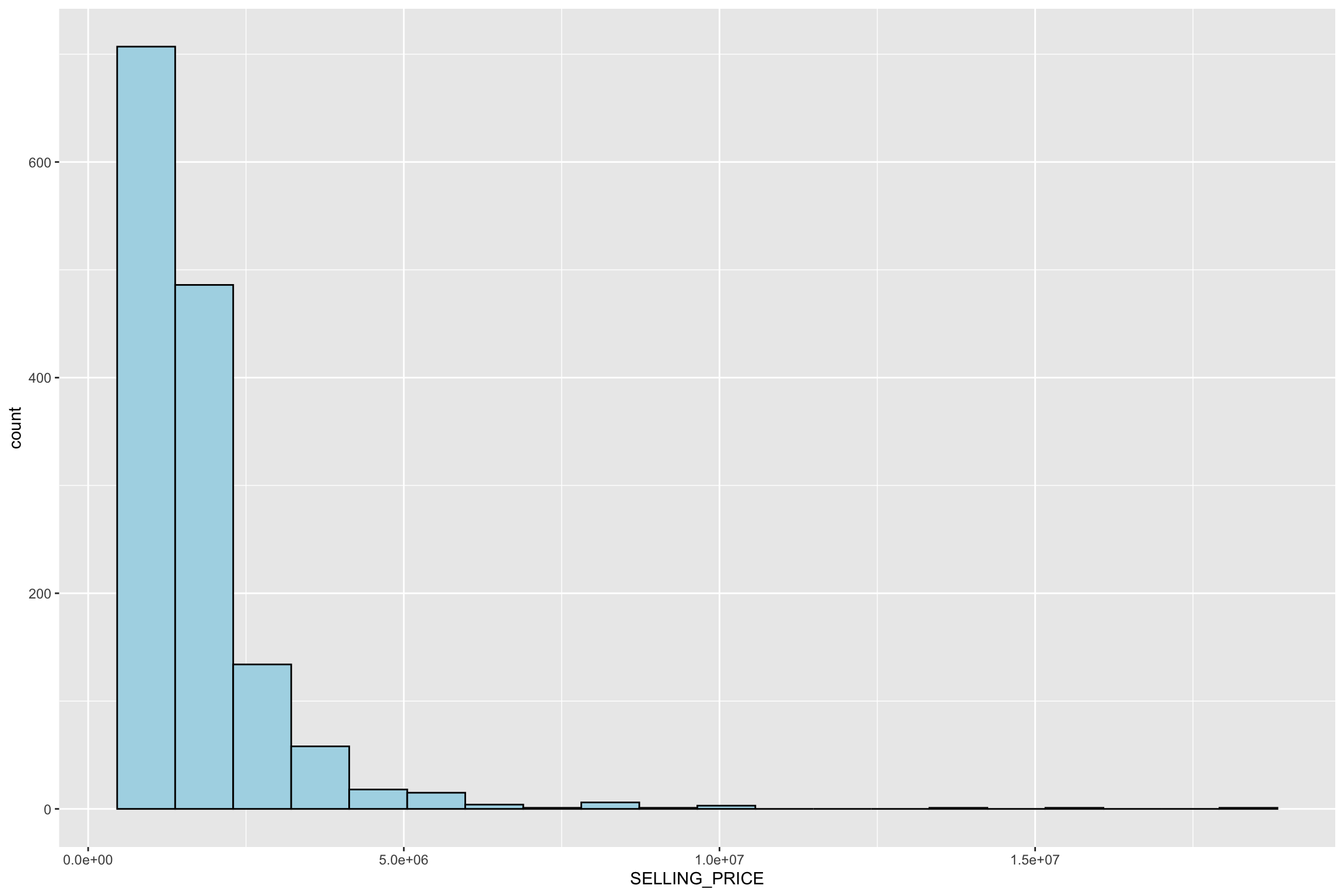

To plot the distribution of SELLING_PRICE by using histograms:

ggplot(data=condo_resale.sf, aes(x=`SELLING_PRICE`)) +

geom_histogram(bins=20, color="black", fill="light blue")

Observations:

- A right skewed distribution.

- This means that more condominium units were transacted at relative lower prices.

- Statistically, the skewed distribution can be normalised by using log transformation.

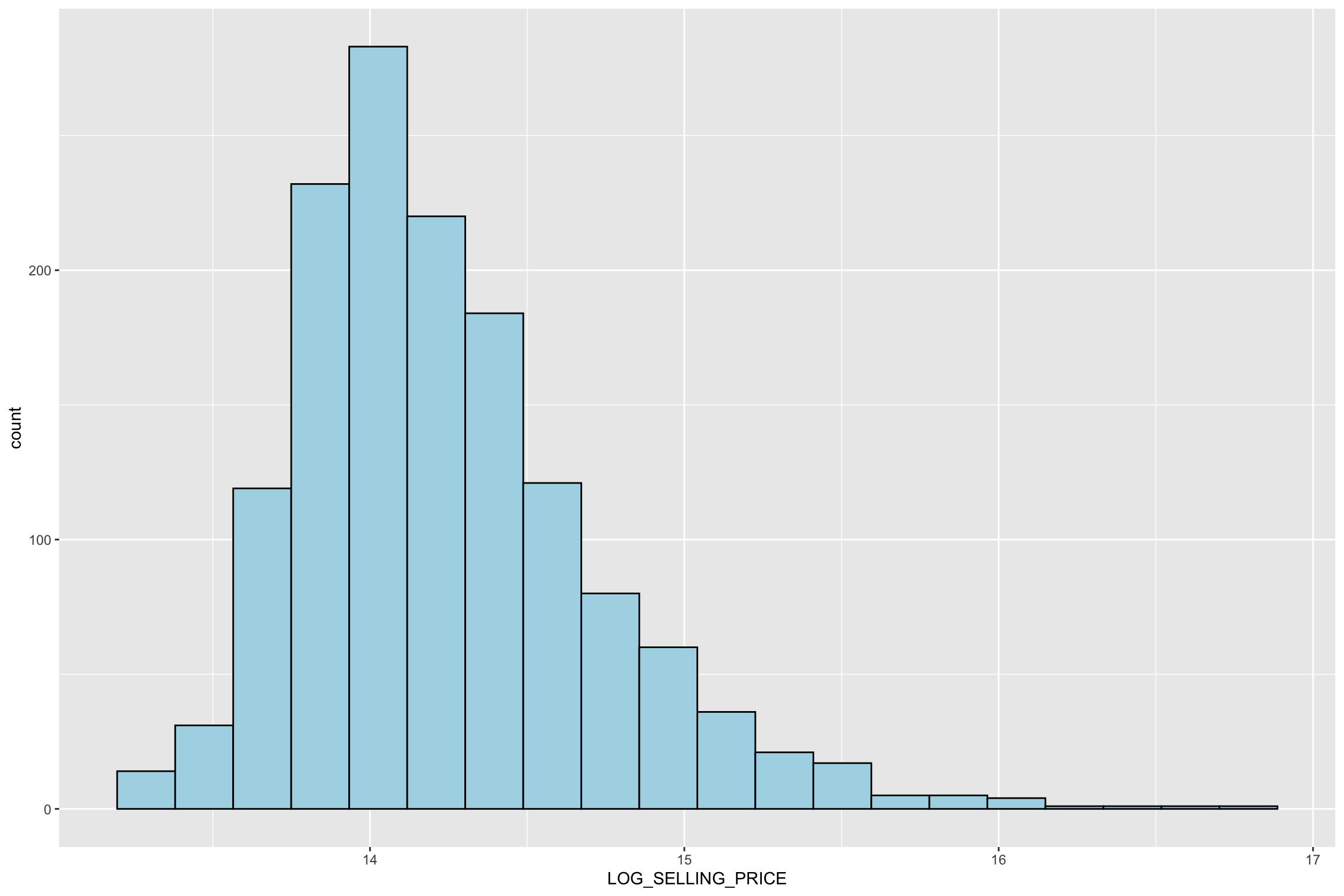

condo_resale.sf <- condo_resale.sf %>%

mutate(`LOG_SELLING_PRICE` = log(SELLING_PRICE))

ggplot(data=condo_resale.sf, aes(x=`LOG_SELLING_PRICE`)) +

geom_histogram(bins=20, color="black", fill="light blue")

Notice that the distribution is relatively less skewed after the transformation.

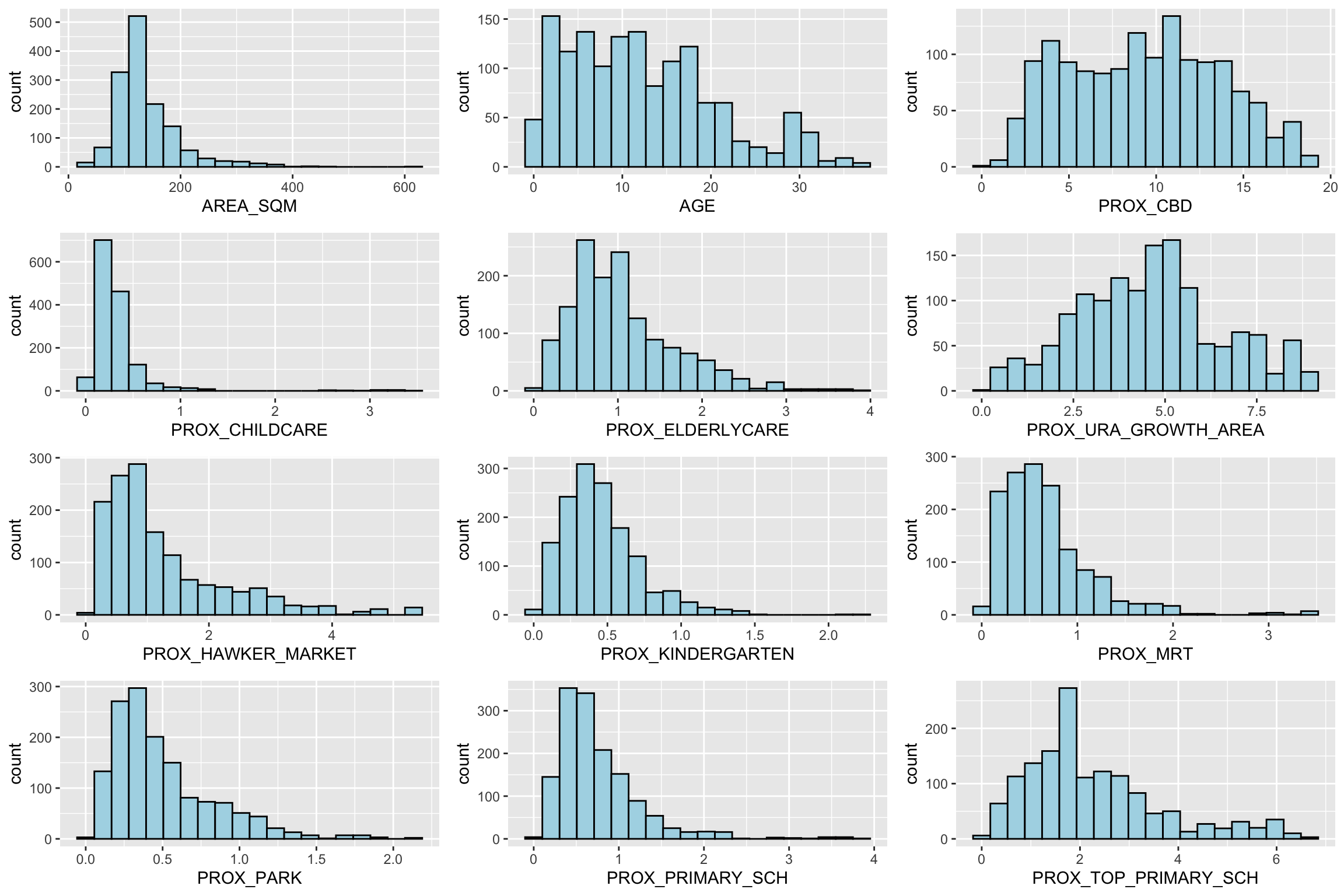

8.3 Multiple Histogram Plots for Variable Distribution

In this section, we will create multiple histograms (also known as

a trellis plot or small multiples) to visualize the distribution

of several variables. We will use the

ggarrange() function from the

ggpubr

package to organize these histograms into a 3-column by 4-row grid

layout.

Show the code

# List of variables to plot

variables <- c("AREA_SQM", "AGE", "PROX_CBD", "PROX_CHILDCARE",

"PROX_ELDERLYCARE", "PROX_URA_GROWTH_AREA",

"PROX_HAWKER_MARKET", "PROX_KINDERGARTEN",

"PROX_MRT", "PROX_PARK", "PROX_PRIMARY_SCH",

"PROX_TOP_PRIMARY_SCH")

histograms <- lapply(variables, function(var) {

ggplot(condo_resale.sf, aes_string(x = var)) +

geom_histogram(bins = 20, color = "black", fill = "lightblue")

})

ggarrange(plotlist = histograms, ncol = 3, nrow = 4)

8.4 Drawing a Statistical Point Map

In this section, we will visualize the geospatial distribution of condominium resale prices in Singapore.

-

The map will be prepared by using tmap package.

-

tmap_mode("view")to use the interactive mode of tmap

-

-

Then, create an interactive point symbol map

-

tm_dots()is used instead oftm_bubbles() -

set.zoom.limitsargument oftm_view()sets the minimum and maximum zoom level to 11 and 14 respectively.

-

-

Lastly,

tmap_mode("plot")to display plot mode

Show the code

tmap_mode("view")

tmap_options(check.and.fix = TRUE)

tm_shape(mpsz_svy21)+

tm_polygons() +

tm_shape(condo_resale.sf) +

tm_dots(col = "SELLING_PRICE",

alpha = 0.6,

style="quantile") +

tm_view(set.zoom.limits = c(11,14))Show the code

tmap_mode("plot")9 Hedonic Pricing Model in R

In this section, we will build a hedonic pricing model for

condominium resale units using the

lm()

function from base R.

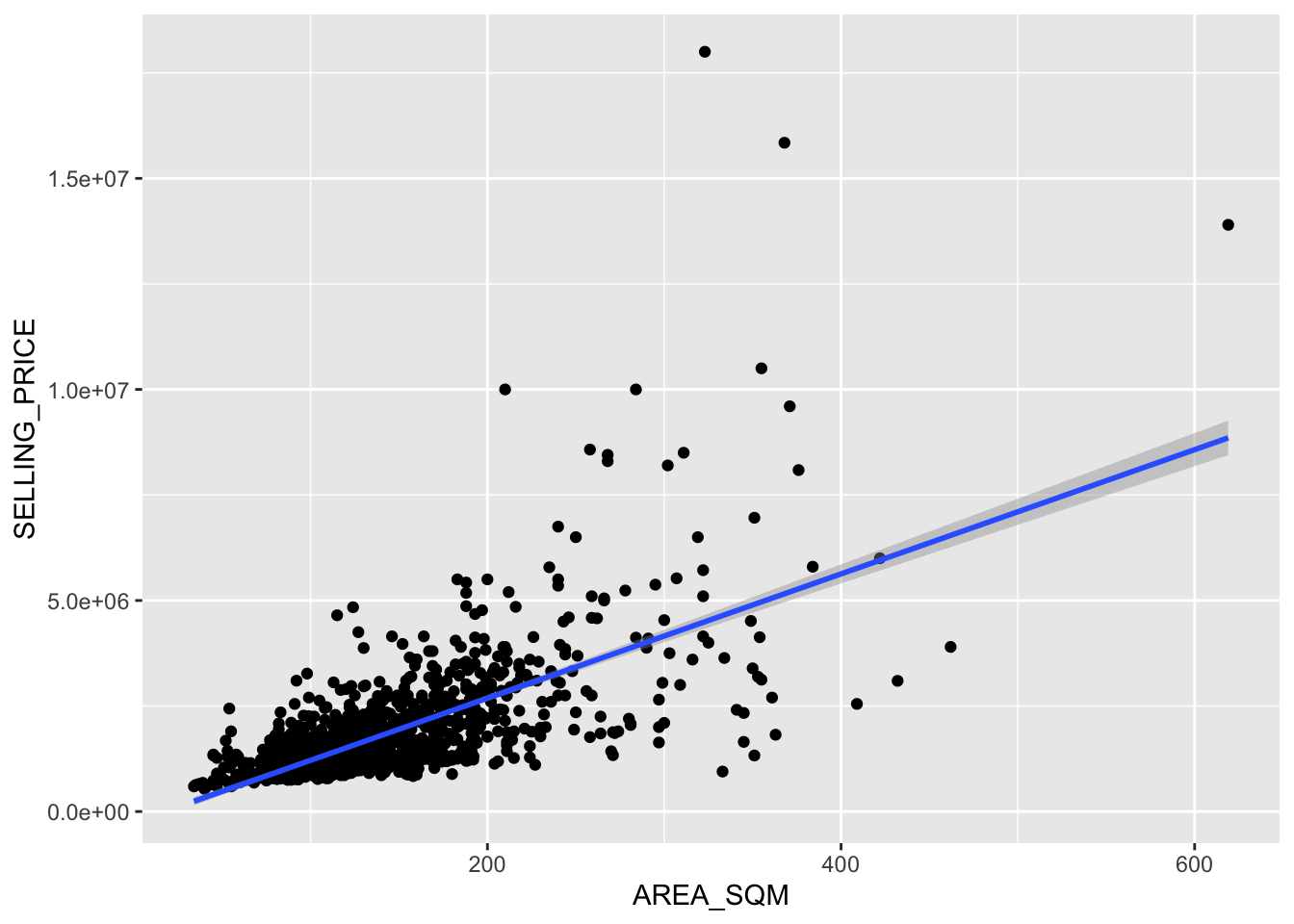

9.1 Simple Linear Regression

We start by modeling SELLING_PRICE as the dependent variable and AREA_SQM as the independent variable.

Call:

lm(formula = SELLING_PRICE ~ AREA_SQM, data = condo_resale.sf)

Residuals:

Min 1Q Median 3Q Max

-3695815 -391764 -87517 258900 13503875

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -258121.1 63517.2 -4.064 5.09e-05 ***

AREA_SQM 14719.0 428.1 34.381 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 942700 on 1434 degrees of freedom

Multiple R-squared: 0.4518, Adjusted R-squared: 0.4515

F-statistic: 1182 on 1 and 1434 DF, p-value: < 2.2e-16Observations:

-

The model equation is:

SELLING_PRICE = -258121.1 + 14719 * AREA_SQM - R-squared: 0.4518, indicating the model explains 45% of the variation in resale prices.

- P-value: The very small p-value (< 0.0001) indicates strong evidence to reject the null hypothesis, suggesting the model is a good fit.

- Coefficients: Both the intercept and slope have p-values < 0.001, confirming that the parameters are significant predictors.

To visualize the fit, we can plot the data and the regression line:

ggplot(data = condo_resale.sf, aes(x = AREA_SQM, y = SELLING_PRICE)) +

geom_point() +

geom_smooth(method = lm)

This scatterplot with a fitted regression line highlights some high-price outliers in the dataset.

9.2 Multiple Linear Regression

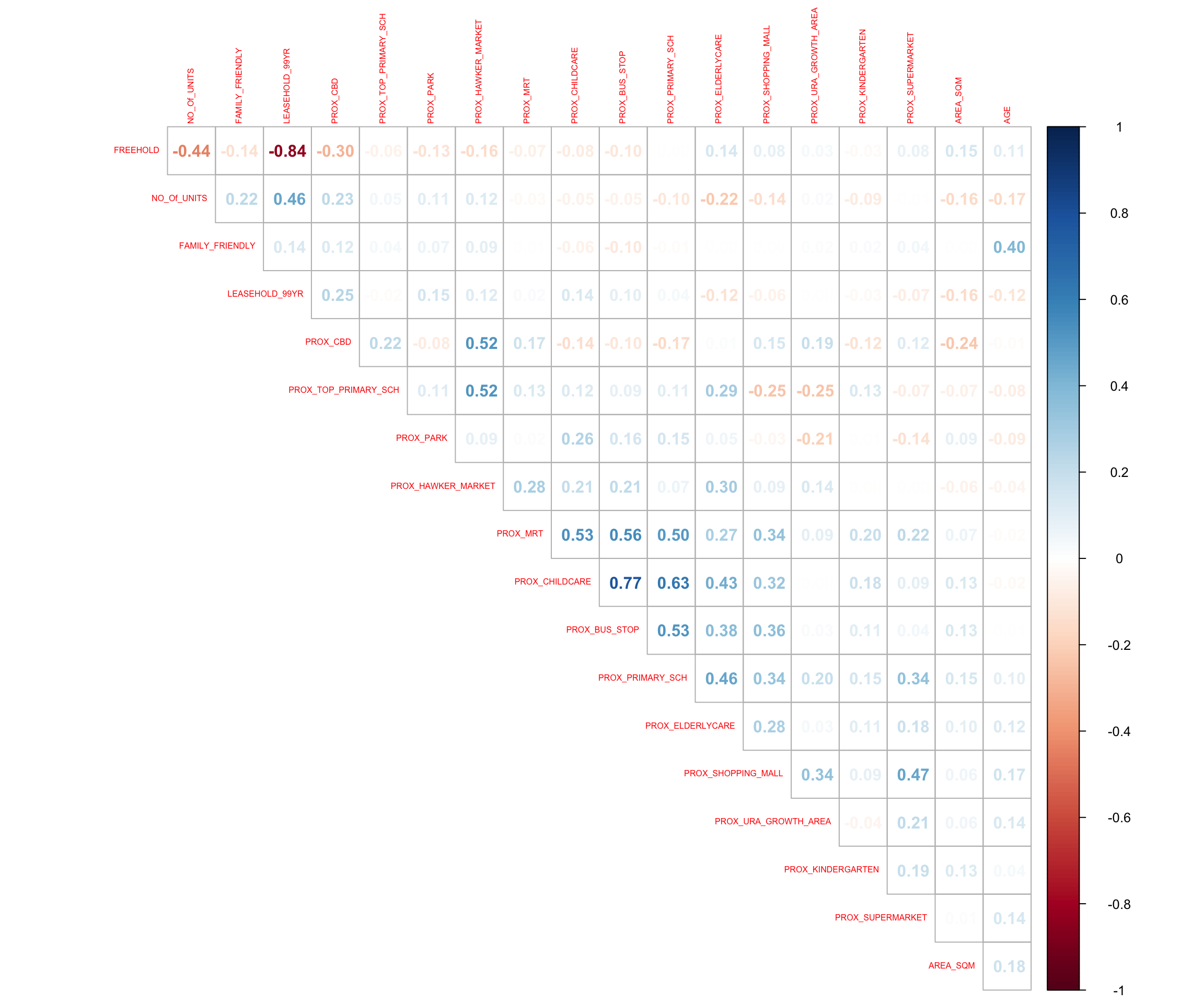

9.2.1 Checking for Multicollinearity

Before building a multiple regression model, it is essential to ensure that the independent variables are not highly correlated, as this can lead to multicollinearity, which compromises the model’s quality.

A correlation matrix is useful for visualizing relationships between variables. In this case, we use the corrplot package to plot a correlation matrix for the independent variables.

corrplot(cor(condo_resale[, 5:23]), diag = FALSE, order = "AOE",

tl.pos = "td", tl.cex = 0.5, method = "number", type = "upper")

Matrix reorder is very important for mining the hiden structure and patter in the matrix. There are four methods in corrplot (parameter order), named “AOE”, “FPC”, “hclust”, “alphabet”. In the code chunk above, AOE order is used. It orders the variables by using the angular order of the eigenvectors method suggested by Michael Friendly.

Observations:

- From the matrix, we observe that Freehold and LEASE_99YEAR are highly correlated, so only Freehold will be included in the model.

9.3 Building the Multiple Linear Regression Model

We now build a hedonic pricing model using multiple linear regression. The model predicts SELLING_PRICE based on several property characteristics.

condo.mlr <- lm(SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_HAWKER_MARKET +

PROX_KINDERGARTEN + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_TOP_PRIMARY_SCH +

PROX_SHOPPING_MALL + PROX_SUPERMARKET +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sf)

summary(condo.mlr)

Call:

lm(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD + PROX_CHILDCARE +

PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA + PROX_HAWKER_MARKET +

PROX_KINDERGARTEN + PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_TOP_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_SUPERMARKET +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sf)

Residuals:

Min 1Q Median 3Q Max

-3475964 -293923 -23069 241043 12260381

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 481728.40 121441.01 3.967 7.65e-05 ***

AREA_SQM 12708.32 369.59 34.385 < 2e-16 ***

AGE -24440.82 2763.16 -8.845 < 2e-16 ***

PROX_CBD -78669.78 6768.97 -11.622 < 2e-16 ***

PROX_CHILDCARE -351617.91 109467.25 -3.212 0.00135 **

PROX_ELDERLYCARE 171029.42 42110.51 4.061 5.14e-05 ***

PROX_URA_GROWTH_AREA 38474.53 12523.57 3.072 0.00217 **

PROX_HAWKER_MARKET 23746.10 29299.76 0.810 0.41782

PROX_KINDERGARTEN 147468.99 82668.87 1.784 0.07466 .

PROX_MRT -314599.68 57947.44 -5.429 6.66e-08 ***

PROX_PARK 563280.50 66551.68 8.464 < 2e-16 ***

PROX_PRIMARY_SCH 180186.08 65237.95 2.762 0.00582 **

PROX_TOP_PRIMARY_SCH 2280.04 20410.43 0.112 0.91107

PROX_SHOPPING_MALL -206604.06 42840.60 -4.823 1.57e-06 ***

PROX_SUPERMARKET -44991.80 77082.64 -0.584 0.55953

PROX_BUS_STOP 683121.35 138353.28 4.938 8.85e-07 ***

NO_Of_UNITS -231.18 89.03 -2.597 0.00951 **

FAMILY_FRIENDLY 140340.77 47020.55 2.985 0.00289 **

FREEHOLD 359913.01 49220.22 7.312 4.38e-13 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 755800 on 1417 degrees of freedom

Multiple R-squared: 0.6518, Adjusted R-squared: 0.6474

F-statistic: 147.4 on 18 and 1417 DF, p-value: < 2.2e-16Observations:

-

Significant predictors:

- AREA_SQM (positive): Larger units have higher selling prices.

- AGE (negative): Older units tend to sell for less.

- PROX_CBD (negative): Proximity to the central business district reduces selling prices.

- PROX_PARK (positive): Proximity to parks increases resale prices.

- FREEHOLD (positive): Freehold properties sell for more than leasehold properties.

-

Non-significant predictors (p > 0.05):

- PROX_HAWKER_MARKET, PROX_TOP_PRIMARY_SCH, PROX_SUPERMARKET show weak or no significant relationship with SELLING_PRICE.

9.4 Revising the Hedonic Pricing Model

After reviewing the initial model, we will now remove non-significant variables to improve the model. The revised multiple linear regression model is calibrated as follows:

condo.mlr1 <- lm(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sf)

ols_regress(condo.mlr1) Model Summary

-----------------------------------------------------------------------------

R 0.807 RMSE 751998.679

R-Squared 0.651 MSE 571471422208.592

Adj. R-Squared 0.647 Coef. Var 43.168

Pred R-Squared 0.638 AIC 42966.758

MAE 414819.628 SBC 43051.072

-----------------------------------------------------------------------------

RMSE: Root Mean Square Error

MSE: Mean Square Error

MAE: Mean Absolute Error

AIC: Akaike Information Criteria

SBC: Schwarz Bayesian Criteria

ANOVA

--------------------------------------------------------------------------------

Sum of

Squares DF Mean Square F Sig.

--------------------------------------------------------------------------------

Regression 1.512586e+15 14 1.080418e+14 189.059 0.0000

Residual 8.120609e+14 1421 571471422208.592

Total 2.324647e+15 1435

--------------------------------------------------------------------------------

Parameter Estimates

-----------------------------------------------------------------------------------------------------------------

model Beta Std. Error Std. Beta t Sig lower upper

-----------------------------------------------------------------------------------------------------------------

(Intercept) 527633.222 108183.223 4.877 0.000 315417.244 739849.200

AREA_SQM 12777.523 367.479 0.584 34.771 0.000 12056.663 13498.382

AGE -24687.739 2754.845 -0.167 -8.962 0.000 -30091.739 -19283.740

PROX_CBD -77131.323 5763.125 -0.263 -13.384 0.000 -88436.469 -65826.176

PROX_CHILDCARE -318472.751 107959.512 -0.084 -2.950 0.003 -530249.889 -106695.613

PROX_ELDERLYCARE 185575.623 39901.864 0.090 4.651 0.000 107302.737 263848.510

PROX_URA_GROWTH_AREA 39163.254 11754.829 0.060 3.332 0.001 16104.571 62221.936

PROX_MRT -294745.107 56916.367 -0.112 -5.179 0.000 -406394.234 -183095.980

PROX_PARK 570504.807 65507.029 0.150 8.709 0.000 442003.938 699005.677

PROX_PRIMARY_SCH 159856.136 60234.599 0.062 2.654 0.008 41697.849 278014.424

PROX_SHOPPING_MALL -220947.251 36561.832 -0.115 -6.043 0.000 -292668.213 -149226.288

PROX_BUS_STOP 682482.221 134513.243 0.134 5.074 0.000 418616.359 946348.082

NO_Of_UNITS -245.480 87.947 -0.053 -2.791 0.005 -418.000 -72.961

FAMILY_FRIENDLY 146307.576 46893.021 0.057 3.120 0.002 54320.593 238294.560

FREEHOLD 350599.812 48506.485 0.136 7.228 0.000 255447.802 445751.821

-----------------------------------------------------------------------------------------------------------------

9.5 Publication-Ready

Table with gtsummary

The gtsummary package provides an elegant way to create publication-ready regression tables. The following code generates a formatted regression report:

tbl_regression(condo.mlr1, intercept = TRUE)|

Characteristic |

Beta |

95% CI 1 |

p-value |

|---|---|---|---|

| (Intercept) | 527,633 | 315,417, 739,849 | <0.001 |

| AREA_SQM | 12,778 | 12,057, 13,498 | <0.001 |

| AGE | -24,688 | -30,092, -19,284 | <0.001 |

| PROX_CBD | -77,131 | -88,436, -65,826 | <0.001 |

| PROX_CHILDCARE | -318,473 | -530,250, -106,696 | 0.003 |

| PROX_ELDERLYCARE | 185,576 | 107,303, 263,849 | <0.001 |

| PROX_URA_GROWTH_AREA | 39,163 | 16,105, 62,222 | <0.001 |

| PROX_MRT | -294,745 | -406,394, -183,096 | <0.001 |

| PROX_PARK | 570,505 | 442,004, 699,006 | <0.001 |

| PROX_PRIMARY_SCH | 159,856 | 41,698, 278,014 | 0.008 |

| PROX_SHOPPING_MALL | -220,947 | -292,668, -149,226 | <0.001 |

| PROX_BUS_STOP | 682,482 | 418,616, 946,348 | <0.001 |

| NO_Of_UNITS | -245 | -418, -73 | 0.005 |

| FAMILY_FRIENDLY | 146,308 | 54,321, 238,295 | 0.002 |

| FREEHOLD | 350,600 | 255,448, 445,752 | <0.001 |

|

1

CI = Confidence Interval |

|||

You can further enhance the report by adding model statistics

using add_glance_table() or

add_glance_source_note():

9.5.1 Checking for Multicollinearity

We can check for multicollinearity using the

olsrr package’s

ols_vif_tol() function:

ols_vif_tol(condo.mlr1) Variables Tolerance VIF

1 AREA_SQM 0.8728554 1.145665

2 AGE 0.7071275 1.414172

3 PROX_CBD 0.6356147 1.573280

4 PROX_CHILDCARE 0.3066019 3.261559

5 PROX_ELDERLYCARE 0.6598479 1.515501

6 PROX_URA_GROWTH_AREA 0.7510311 1.331503

7 PROX_MRT 0.5236090 1.909822

8 PROX_PARK 0.8279261 1.207837

9 PROX_PRIMARY_SCH 0.4524628 2.210126

10 PROX_SHOPPING_MALL 0.6738795 1.483945

11 PROX_BUS_STOP 0.3514118 2.845664

12 NO_Of_UNITS 0.6901036 1.449058

13 FAMILY_FRIENDLY 0.7244157 1.380423

14 FREEHOLD 0.6931163 1.442759Observations:

Since the VIF values are all below 10, there is no indication of multicollinearity among the independent variables.

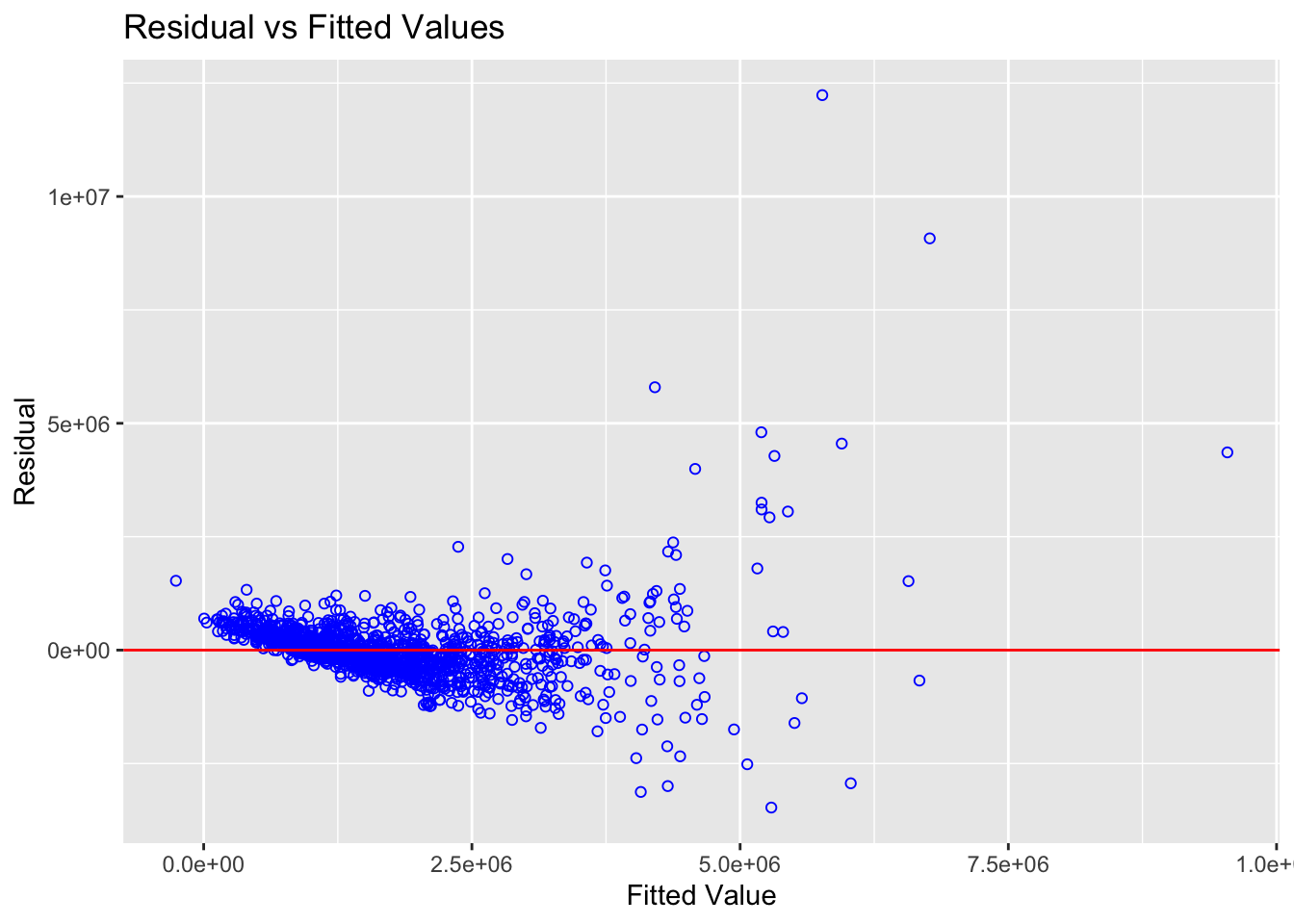

9.5.2 Test for Non-Linearity

In multiple linear regression, it is important for us to test the assumption that linearity and additivity of the relationship between dependent and independent variables.

To test the linearity assumption, we use the

ols_plot_resid_fit() function.

ols_plot_resid_fit(condo.mlr1)

Observations:

Most points are scattered around the 0 line, hence we can safely conclude that the relationships between the dependent variable and independent variables are linear.

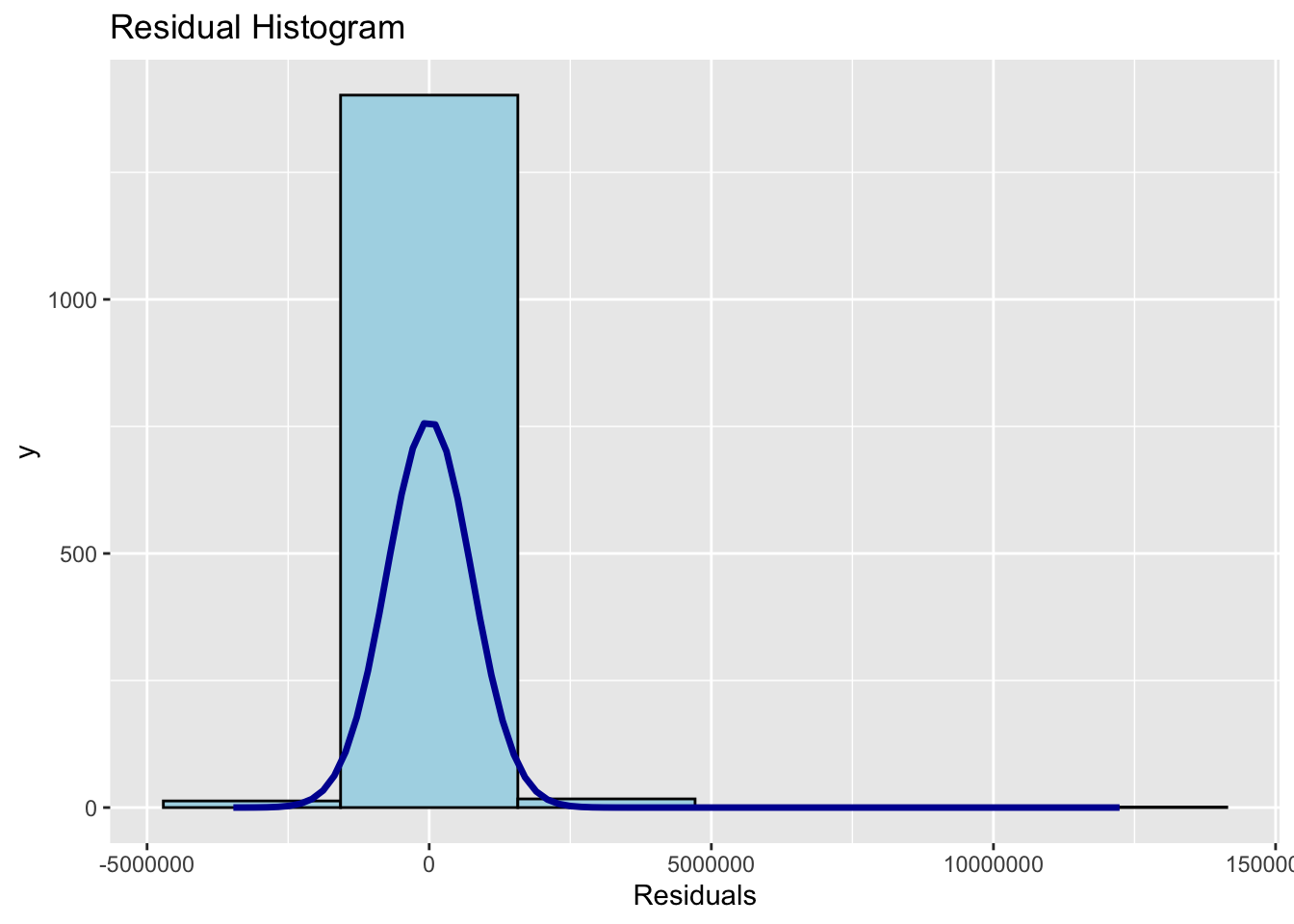

9.5.3 Test for Normality Assumption

We can assess the normality of residuals with a histogram:

ols_plot_resid_hist(condo.mlr1)

The residuals appear normally distributed. For a formal test, we

can use ols_test_normality():

ols_test_normality(condo.mlr1)-----------------------------------------------

Test Statistic pvalue

-----------------------------------------------

Shapiro-Wilk 0.6856 0.0000

Kolmogorov-Smirnov 0.1366 0.0000

Cramer-von Mises 121.0768 0.0000

Anderson-Darling 67.9551 0.0000

-----------------------------------------------Observations:

The summary table above reveals that the p-values of the four tests are way smaller than the alpha value of 0.05. Hence we will reject the null hypothesis and infer that there is statistical evidence that the residual are not normally distributed.

9.5.4 Testing for Spatial Autocorrelation

Since the hedonic model involves geographically referenced data, it is important to visualize the residuals and test for spatial autocorrelation.

First, we export the residuals from the hedonic pricing model into a data frame.

mlr.output <- as.data.frame(condo.mlr1$residuals)Next, we join the residuals with the condo_resale.sf spatial data frame:

condo_resale.res.sf <- cbind(condo_resale.sf, condo.mlr1$residuals) %>%

rename(MLR_RES = condo.mlr1.residuals)We convert the condo_resale.res.sf from an sf object to a SpatialPointsDataFrame for use with the spdep package:

condo_resale.sp <- as_Spatial(condo_resale.res.sf)

condo_resale.spclass : SpatialPointsDataFrame

features : 1436

extent : 14940.85, 43352.45, 24765.67, 48382.81 (xmin, xmax, ymin, ymax)

crs : +proj=tmerc +lat_0=1.36666666666667 +lon_0=103.833333333333 +k=1 +x_0=28001.642 +y_0=38744.572 +ellps=WGS84 +towgs84=0,0,0,0,0,0,0 +units=m +no_defs

variables : 23

names : POSTCODE, SELLING_PRICE, AREA_SQM, AGE, PROX_CBD, PROX_CHILDCARE, PROX_ELDERLYCARE, PROX_URA_GROWTH_AREA, PROX_HAWKER_MARKET, PROX_KINDERGARTEN, PROX_MRT, PROX_PARK, PROX_PRIMARY_SCH, PROX_TOP_PRIMARY_SCH, PROX_SHOPPING_MALL, ...

min values : 18965, 540000, 34, 0, 0.386916393, 0.004927023, 0.054508623, 0.214539508, 0.051817113, 0.004927023, 0.052779424, 0.029064164, 0.077106132, 0.077106132, 0, ...

max values : 828833, 1.8e+07, 619, 37, 19.18042832, 3.46572633, 3.949157205, 9.15540001, 5.374348075, 2.229045366, 3.48037319, 2.16104919, 3.928989144, 6.748192062, 3.477433767, ... Using tmap, we visualize the spatial distribution of the residuals:

tmap_mode("view")

tm_shape(mpsz_svy21) +

tmap_options(check.and.fix = TRUE) +

tm_polygons(alpha = 0.4) +

tm_shape(condo_resale.res.sf) +

tm_dots(col = "MLR_RES", alpha = 0.6, style = "quantile") +

tm_view(set.zoom.limits = c(11, 14))tmap_mode("plot")Observations:

The figure above reveal that there is sign of spatial autocorrelation.

To formally test for spatial autocorrelation using Moran’s I Test, we first compute a distance-based weight matrix:

nb <- dnearneigh(coordinates(condo_resale.sp), 0, 1500, longlat = FALSE)

summary(nb)Neighbour list object:

Number of regions: 1436

Number of nonzero links: 66266

Percentage nonzero weights: 3.213526

Average number of links: 46.14624

10 disjoint connected subgraphs

Link number distribution:

1 3 5 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

3 3 9 4 3 15 10 19 17 45 19 5 14 29 19 6 35 45 18 47

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44

16 43 22 26 21 11 9 23 22 13 16 25 21 37 16 18 8 21 4 12

45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

8 36 18 14 14 43 11 12 8 13 12 13 4 5 6 12 11 20 29 33

65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84

15 20 10 14 15 15 11 16 12 10 8 19 12 14 9 8 4 13 11 6

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104

4 9 4 4 4 6 2 16 9 4 5 9 3 9 4 2 1 2 1 1

105 106 107 108 109 110 112 116 125

1 5 9 2 1 3 1 1 1

3 least connected regions:

193 194 277 with 1 link

1 most connected region:

285 with 125 linksConvert the neighbor list into spatial weights:

nb_lw <- nb2listw(nb, style = 'W')

summary(nb_lw)Characteristics of weights list object:

Neighbour list object:

Number of regions: 1436

Number of nonzero links: 66266

Percentage nonzero weights: 3.213526

Average number of links: 46.14624

10 disjoint connected subgraphs

Link number distribution:

1 3 5 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

3 3 9 4 3 15 10 19 17 45 19 5 14 29 19 6 35 45 18 47

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44

16 43 22 26 21 11 9 23 22 13 16 25 21 37 16 18 8 21 4 12

45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

8 36 18 14 14 43 11 12 8 13 12 13 4 5 6 12 11 20 29 33

65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84

15 20 10 14 15 15 11 16 12 10 8 19 12 14 9 8 4 13 11 6

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104

4 9 4 4 4 6 2 16 9 4 5 9 3 9 4 2 1 2 1 1

105 106 107 108 109 110 112 116 125

1 5 9 2 1 3 1 1 1

3 least connected regions:

193 194 277 with 1 link

1 most connected region:

285 with 125 links

Weights style: W

Weights constants summary:

n nn S0 S1 S2

W 1436 2062096 1436 94.81916 5798.341Finally, perform Moran’s I test on the model residuals:

lm.morantest(condo.mlr1, nb_lw)

Global Moran I for regression residuals

data:

model: lm(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA + PROX_MRT +

PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD, data = condo_resale.sf)

weights: nb_lw

Moran I statistic standard deviate = 24.366, p-value < 2.2e-16

alternative hypothesis: greater

sample estimates:

Observed Moran I Expectation Variance

1.438876e-01 -5.487594e-03 3.758259e-05 Observations:

- P-value: The p-value is extremely small (< 0.05), leading us to reject the null hypothesis that residuals are randomly distributed.

- Observed Moran’s I: The value of 0.1424418 (greater than 0) indicates that residuals show a clustered pattern, confirming the presence of spatial autocorrelation.

10 Building Hedonic Pricing Models using GWmodel

In this section, we will model hedonic pricing using both fixed and adaptive bandwidth schemes.

10.1 Building Fixed Bandwidth GWR Model

10.1.1 Computing Fixed Bandwidth

We use the bw.gwr() function from the

GWModel package to determine the optimal fixed

bandwidth for the model.

Setting adaptive = FALSE ensures that we are

calculating a fixed bandwidth. There are two possible approaches

for determining the stopping rule:

CV cross-validation and AICc.

In this case, we use the cross-validation approach (approach = "CV").

bw.fixed <- bw.gwr(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_SHOPPING_MALL + PROX_BUS_STOP + NO_Of_UNITS +

FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp,

approach = "CV",

kernel = "gaussian",

adaptive = FALSE,

longlat = FALSE)Fixed bandwidth: 17660.96 CV score: 8.259118e+14

Fixed bandwidth: 10917.26 CV score: 7.970454e+14

Fixed bandwidth: 6749.419 CV score: 7.273273e+14

Fixed bandwidth: 4173.553 CV score: 6.300006e+14

Fixed bandwidth: 2581.58 CV score: 5.404958e+14

Fixed bandwidth: 1597.687 CV score: 4.857515e+14

Fixed bandwidth: 989.6077 CV score: 4.722431e+14

Fixed bandwidth: 613.7939 CV score: 1.379526e+16

Fixed bandwidth: 1221.873 CV score: 4.778717e+14

Fixed bandwidth: 846.0596 CV score: 4.791629e+14

Fixed bandwidth: 1078.325 CV score: 4.751406e+14

Fixed bandwidth: 934.7772 CV score: 4.72518e+14

Fixed bandwidth: 1023.495 CV score: 4.730305e+14

Fixed bandwidth: 968.6643 CV score: 4.721317e+14

Fixed bandwidth: 955.7206 CV score: 4.722072e+14

Fixed bandwidth: 976.6639 CV score: 4.721387e+14

Fixed bandwidth: 963.7202 CV score: 4.721484e+14

Fixed bandwidth: 971.7199 CV score: 4.721293e+14

Fixed bandwidth: 973.6083 CV score: 4.721309e+14

Fixed bandwidth: 970.5527 CV score: 4.721295e+14

Fixed bandwidth: 972.4412 CV score: 4.721296e+14

Fixed bandwidth: 971.2741 CV score: 4.721292e+14

Fixed bandwidth: 970.9985 CV score: 4.721293e+14

Fixed bandwidth: 971.4443 CV score: 4.721292e+14

Fixed bandwidth: 971.5496 CV score: 4.721293e+14

Fixed bandwidth: 971.3793 CV score: 4.721292e+14

Fixed bandwidth: 971.3391 CV score: 4.721292e+14

Fixed bandwidth: 971.3143 CV score: 4.721292e+14

Fixed bandwidth: 971.3545 CV score: 4.721292e+14

Fixed bandwidth: 971.3296 CV score: 4.721292e+14

Fixed bandwidth: 971.345 CV score: 4.721292e+14

Fixed bandwidth: 971.3355 CV score: 4.721292e+14

Fixed bandwidth: 971.3413 CV score: 4.721292e+14

Fixed bandwidth: 971.3377 CV score: 4.721292e+14

Fixed bandwidth: 971.34 CV score: 4.721292e+14

Fixed bandwidth: 971.3405 CV score: 4.721292e+14

Fixed bandwidth: 971.3396 CV score: 4.721292e+14

Fixed bandwidth: 971.3402 CV score: 4.721292e+14

Fixed bandwidth: 971.3398 CV score: 4.721292e+14

Fixed bandwidth: 971.34 CV score: 4.721292e+14

Fixed bandwidth: 971.3399 CV score: 4.721292e+14

Fixed bandwidth: 971.34 CV score: 4.721292e+14 The recommended bandwidth is 971.34 meters.

Quiz Answer:

The bandwidth is in meters because the model is using

projected coordinates, SVY21, where distances are measured

in meters.

10.1.2 GWModel Method - Fixed Bandwidth

We can now calibrate the GWR model using a fixed bandwidth and a Gaussian kernel with the following code:

gwr.fixed <- gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_SHOPPING_MALL + PROX_BUS_STOP + NO_Of_UNITS +

FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp,

bw = bw.fixed,

kernel = 'gaussian',

longlat = FALSE)

gwr.fixed ***********************************************************************

* Package GWmodel *

***********************************************************************

Program starts at: 2024-10-14 19:55:45.822271

Call:

gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp, bw = bw.fixed, kernel = "gaussian",

longlat = FALSE)

Dependent (y) variable: SELLING_PRICE

Independent variables: AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

Number of data points: 1436

***********************************************************************

* Results of Global Regression *

***********************************************************************

Call:

lm(formula = formula, data = data)

Residuals:

Min 1Q Median 3Q Max

-3470778 -298119 -23481 248917 12234210

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 527633.22 108183.22 4.877 1.20e-06 ***

AREA_SQM 12777.52 367.48 34.771 < 2e-16 ***

AGE -24687.74 2754.84 -8.962 < 2e-16 ***

PROX_CBD -77131.32 5763.12 -13.384 < 2e-16 ***

PROX_CHILDCARE -318472.75 107959.51 -2.950 0.003231 **

PROX_ELDERLYCARE 185575.62 39901.86 4.651 3.61e-06 ***

PROX_URA_GROWTH_AREA 39163.25 11754.83 3.332 0.000885 ***

PROX_MRT -294745.11 56916.37 -5.179 2.56e-07 ***

PROX_PARK 570504.81 65507.03 8.709 < 2e-16 ***

PROX_PRIMARY_SCH 159856.14 60234.60 2.654 0.008046 **

PROX_SHOPPING_MALL -220947.25 36561.83 -6.043 1.93e-09 ***

PROX_BUS_STOP 682482.22 134513.24 5.074 4.42e-07 ***

NO_Of_UNITS -245.48 87.95 -2.791 0.005321 **

FAMILY_FRIENDLY 146307.58 46893.02 3.120 0.001845 **

FREEHOLD 350599.81 48506.48 7.228 7.98e-13 ***

---Significance stars

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 756000 on 1421 degrees of freedom

Multiple R-squared: 0.6507

Adjusted R-squared: 0.6472

F-statistic: 189.1 on 14 and 1421 DF, p-value: < 2.2e-16

***Extra Diagnostic information

Residual sum of squares: 8.120609e+14

Sigma(hat): 752522.9

AIC: 42966.76

AICc: 42967.14

BIC: 41731.39

***********************************************************************

* Results of Geographically Weighted Regression *

***********************************************************************

*********************Model calibration information*********************

Kernel function: gaussian

Fixed bandwidth: 971.34

Regression points: the same locations as observations are used.

Distance metric: Euclidean distance metric is used.

****************Summary of GWR coefficient estimates:******************

Min. 1st Qu. Median 3rd Qu.

Intercept -3.5988e+07 -5.1998e+05 7.6780e+05 1.7412e+06

AREA_SQM 1.0003e+03 5.2758e+03 7.4740e+03 1.2301e+04

AGE -1.3475e+05 -2.0813e+04 -8.6260e+03 -3.7784e+03

PROX_CBD -7.7047e+07 -2.3608e+05 -8.3599e+04 3.4646e+04

PROX_CHILDCARE -6.0097e+06 -3.3667e+05 -9.7426e+04 2.9007e+05

PROX_ELDERLYCARE -3.5001e+06 -1.5970e+05 3.1970e+04 1.9577e+05

PROX_URA_GROWTH_AREA -3.0170e+06 -8.2013e+04 7.0749e+04 2.2612e+05

PROX_MRT -3.5282e+06 -6.5836e+05 -1.8833e+05 3.6922e+04

PROX_PARK -1.2062e+06 -2.1732e+05 3.5383e+04 4.1335e+05

PROX_PRIMARY_SCH -2.2695e+07 -1.7066e+05 4.8472e+04 5.1555e+05

PROX_SHOPPING_MALL -7.2585e+06 -1.6684e+05 -1.0517e+04 1.5923e+05

PROX_BUS_STOP -1.4676e+06 -4.5207e+04 3.7601e+05 1.1664e+06

NO_Of_UNITS -1.3170e+03 -2.4822e+02 -3.0846e+01 2.5496e+02

FAMILY_FRIENDLY -2.2749e+06 -1.1140e+05 7.6214e+03 1.6107e+05

FREEHOLD -9.2067e+06 3.8074e+04 1.5169e+05 3.7528e+05

Max.

Intercept 112794435

AREA_SQM 21575

AGE 434203

PROX_CBD 2704604

PROX_CHILDCARE 1654086

PROX_ELDERLYCARE 38867861

PROX_URA_GROWTH_AREA 78515805

PROX_MRT 3124325

PROX_PARK 18122439

PROX_PRIMARY_SCH 4637517

PROX_SHOPPING_MALL 1529953

PROX_BUS_STOP 11342209

NO_Of_UNITS 12907

FAMILY_FRIENDLY 1720745

FREEHOLD 6073642

************************Diagnostic information*************************

Number of data points: 1436

Effective number of parameters (2trace(S) - trace(S'S)): 438.3807

Effective degrees of freedom (n-2trace(S) + trace(S'S)): 997.6193

AICc (GWR book, Fotheringham, et al. 2002, p. 61, eq 2.33): 42263.61

AIC (GWR book, Fotheringham, et al. 2002,GWR p. 96, eq. 4.22): 41632.36

BIC (GWR book, Fotheringham, et al. 2002,GWR p. 61, eq. 2.34): 42515.71

Residual sum of squares: 2.534069e+14

R-square value: 0.8909912

Adjusted R-square value: 0.8430418

***********************************************************************

Program stops at: 2024-10-14 19:55:47.015626 Observations:

The AICc for this fixed bandwidth GWR model is 42263.61, which is lower than the global multiple linear regression model (AICc = 42967.1), indicating a better fit.

10.2 Building Adaptive Bandwidth GWR Model

10.2.1 Computing the Adaptive Bandwidth

To compute the adaptive bandwidth, we set

adaptive = TRUE in the

bw.gwr() function:

bw.adaptive <- bw.gwr(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp,

approach = "CV",

kernel = "gaussian",

adaptive = TRUE,

longlat = FALSE)Adaptive bandwidth: 895 CV score: 7.952401e+14

Adaptive bandwidth: 561 CV score: 7.667364e+14

Adaptive bandwidth: 354 CV score: 6.953454e+14

Adaptive bandwidth: 226 CV score: 6.15223e+14

Adaptive bandwidth: 147 CV score: 5.674373e+14

Adaptive bandwidth: 98 CV score: 5.426745e+14

Adaptive bandwidth: 68 CV score: 5.168117e+14

Adaptive bandwidth: 49 CV score: 4.859631e+14

Adaptive bandwidth: 37 CV score: 4.646518e+14

Adaptive bandwidth: 30 CV score: 4.422088e+14

Adaptive bandwidth: 25 CV score: 4.430816e+14

Adaptive bandwidth: 32 CV score: 4.505602e+14

Adaptive bandwidth: 27 CV score: 4.462172e+14

Adaptive bandwidth: 30 CV score: 4.422088e+14 Observations:

The result suggests using 30 data points for the adaptive bandwidth.

10.2.2 Constructing the Adaptive Bandwidth GWR Model

We can now calibrate the GWR model with the adaptive bandwidth:

gwr.adaptive <- gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp,

bw = bw.adaptive,

kernel = 'gaussian',

adaptive = TRUE,

longlat = FALSE)

gwr.adaptive ***********************************************************************

* Package GWmodel *

***********************************************************************

Program starts at: 2024-10-14 19:55:56.103874

Call:

gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp, bw = bw.adaptive, kernel = "gaussian",

adaptive = TRUE, longlat = FALSE)

Dependent (y) variable: SELLING_PRICE

Independent variables: AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

Number of data points: 1436

***********************************************************************

* Results of Global Regression *

***********************************************************************

Call:

lm(formula = formula, data = data)

Residuals:

Min 1Q Median 3Q Max

-3470778 -298119 -23481 248917 12234210

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 527633.22 108183.22 4.877 1.20e-06 ***

AREA_SQM 12777.52 367.48 34.771 < 2e-16 ***

AGE -24687.74 2754.84 -8.962 < 2e-16 ***

PROX_CBD -77131.32 5763.12 -13.384 < 2e-16 ***

PROX_CHILDCARE -318472.75 107959.51 -2.950 0.003231 **

PROX_ELDERLYCARE 185575.62 39901.86 4.651 3.61e-06 ***

PROX_URA_GROWTH_AREA 39163.25 11754.83 3.332 0.000885 ***

PROX_MRT -294745.11 56916.37 -5.179 2.56e-07 ***

PROX_PARK 570504.81 65507.03 8.709 < 2e-16 ***

PROX_PRIMARY_SCH 159856.14 60234.60 2.654 0.008046 **

PROX_SHOPPING_MALL -220947.25 36561.83 -6.043 1.93e-09 ***

PROX_BUS_STOP 682482.22 134513.24 5.074 4.42e-07 ***

NO_Of_UNITS -245.48 87.95 -2.791 0.005321 **

FAMILY_FRIENDLY 146307.58 46893.02 3.120 0.001845 **

FREEHOLD 350599.81 48506.48 7.228 7.98e-13 ***

---Significance stars

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 756000 on 1421 degrees of freedom

Multiple R-squared: 0.6507

Adjusted R-squared: 0.6472

F-statistic: 189.1 on 14 and 1421 DF, p-value: < 2.2e-16

***Extra Diagnostic information

Residual sum of squares: 8.120609e+14

Sigma(hat): 752522.9

AIC: 42966.76

AICc: 42967.14

BIC: 41731.39

***********************************************************************

* Results of Geographically Weighted Regression *

***********************************************************************

*********************Model calibration information*********************

Kernel function: gaussian

Adaptive bandwidth: 30 (number of nearest neighbours)

Regression points: the same locations as observations are used.

Distance metric: Euclidean distance metric is used.

****************Summary of GWR coefficient estimates:******************

Min. 1st Qu. Median 3rd Qu.

Intercept -1.3487e+08 -2.4669e+05 7.7928e+05 1.6194e+06

AREA_SQM 3.3188e+03 5.6285e+03 7.7825e+03 1.2738e+04

AGE -9.6746e+04 -2.9288e+04 -1.4043e+04 -5.6119e+03

PROX_CBD -2.5330e+06 -1.6256e+05 -7.7242e+04 2.6624e+03

PROX_CHILDCARE -1.2790e+06 -2.0175e+05 8.7158e+03 3.7778e+05

PROX_ELDERLYCARE -1.6212e+06 -9.2050e+04 6.1029e+04 2.8184e+05

PROX_URA_GROWTH_AREA -7.2686e+06 -3.0350e+04 4.5869e+04 2.4613e+05

PROX_MRT -4.3781e+07 -6.7282e+05 -2.2115e+05 -7.4593e+04

PROX_PARK -2.9020e+06 -1.6782e+05 1.1601e+05 4.6572e+05

PROX_PRIMARY_SCH -8.6418e+05 -1.6627e+05 -7.7853e+03 4.3222e+05

PROX_SHOPPING_MALL -1.8272e+06 -1.3175e+05 -1.4049e+04 1.3799e+05

PROX_BUS_STOP -2.0579e+06 -7.1461e+04 4.1104e+05 1.2071e+06

NO_Of_UNITS -2.1993e+03 -2.3685e+02 -3.4699e+01 1.1657e+02

FAMILY_FRIENDLY -5.9879e+05 -5.0927e+04 2.6173e+04 2.2481e+05

FREEHOLD -1.6340e+05 4.0765e+04 1.9023e+05 3.7960e+05

Max.

Intercept 18758355

AREA_SQM 23064

AGE 13303

PROX_CBD 11346650

PROX_CHILDCARE 2892127

PROX_ELDERLYCARE 2465671

PROX_URA_GROWTH_AREA 7384059

PROX_MRT 1186242

PROX_PARK 2588497

PROX_PRIMARY_SCH 3381462

PROX_SHOPPING_MALL 38038564

PROX_BUS_STOP 12081592

NO_Of_UNITS 1010

FAMILY_FRIENDLY 2072414

FREEHOLD 1813995

************************Diagnostic information*************************

Number of data points: 1436

Effective number of parameters (2trace(S) - trace(S'S)): 350.3088

Effective degrees of freedom (n-2trace(S) + trace(S'S)): 1085.691

AICc (GWR book, Fotheringham, et al. 2002, p. 61, eq 2.33): 41982.22

AIC (GWR book, Fotheringham, et al. 2002,GWR p. 96, eq. 4.22): 41546.74

BIC (GWR book, Fotheringham, et al. 2002,GWR p. 61, eq. 2.34): 41914.08

Residual sum of squares: 2.528227e+14

R-square value: 0.8912425

Adjusted R-square value: 0.8561185

***********************************************************************

Program stops at: 2024-10-14 19:55:57.424832 Observations:

The AICc for the adaptive bandwidth GWR model is 41982.22, which is even lower than the fixed bandwidth GWR model (AICc = 42263.61), indicating an improved model fit.

10.3 Visualizing GWR Output

The output from GWR includes fields for observed and predicted values, residuals, local R², condition numbers, and explanatory variable coefficients:

- Condition Number: Identifies areas with strong local collinearity. Values over 30 may indicate unreliable results.

- Local R²: Indicates how well the local model fits the observed values (ranges between 0.0 and 1.0). Mapping this can reveal where the model predicts well or poorly.

- Predicted Values: The estimated y values (fitted) by GWR.

- Residuals: Difference between observed and predicted values. Standardized residuals should have a mean of zero and a standard deviation of 1.

- Coefficient Standard Error: Measures the reliability of coefficient estimates. Smaller standard errors relative to coefficients indicate greater confidence in estimates.

These fields are stored in the SDF object from

the GWR output, which is a SpatialPointsDataFrame or

SpatialPolygonsDataFrame.

10.4 Converting SDF to sf Data Frame

We first convert the SDF into an sf data frame for visualization:

condo_resale.sf.adaptive <- st_as_sf(gwr.adaptive$SDF) %>%

st_transform(crs = 3414)

condo_resale.sf.adaptive.svy21 <- st_transform(condo_resale.sf.adaptive, 3414)

condo_resale.sf.adaptive.svy21 Simple feature collection with 1436 features and 51 fields

Geometry type: POINT

Dimension: XY

Bounding box: xmin: 14940.85 ymin: 24765.67 xmax: 43352.45 ymax: 48382.81

Projected CRS: SVY21 / Singapore TM

First 10 features:

Intercept AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE

1 2050011.7 9561.892 -9514.634 -120681.9 319266.92 -393417.79

2 1633128.2 16576.853 -58185.479 -149434.2 441102.18 325188.74

3 3433608.2 13091.861 -26707.386 -259397.8 -120116.82 535855.81

4 234358.9 20730.601 -93308.988 2426853.7 480825.28 314783.72

5 2285804.9 6722.836 -17608.018 -316835.5 90764.78 -137384.61

6 -3568877.4 6039.581 -26535.592 327306.1 -152531.19 -700392.85

7 -2874842.4 16843.575 -59166.727 -983577.2 -177810.50 -122384.02

8 2038086.0 6905.135 -17681.897 -285076.6 70259.40 -96012.78

9 1718478.4 9580.703 -14401.128 105803.4 -657698.02 -123276.00

10 3457054.0 14072.011 -31579.884 -234895.4 79961.45 548581.04

PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH

1 -159980.20 -299742.96 -172104.47 242668.03

2 -142290.39 -2510522.23 523379.72 1106830.66

3 -253621.21 -936853.28 209099.85 571462.33

4 -2679297.89 -2039479.50 -759153.26 3127477.21

5 303714.81 -44567.05 -10284.62 30413.56

6 -28051.25 733566.47 1511488.92 320878.23

7 1397676.38 -2745430.34 710114.74 1786570.95

8 269368.71 -14552.99 73533.34 53359.73

9 -361974.72 -476785.32 -132067.59 -40128.92

10 -150024.38 -1503835.53 574155.47 108996.67

PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

1 300881.390 1210615.4 104.8290640 -9075.370 303955.6

2 -87693.378 1843587.2 -288.3441183 310074.664 396221.3

3 -126732.712 1411924.9 -9.5532945 5949.746 168821.7

4 -29593.342 7225577.5 -161.3551620 1556178.531 1212515.6

5 -7490.586 677577.0 42.2659674 58986.951 328175.2

6 258583.881 1086012.6 -214.3671271 201992.641 471873.1

7 -384251.210 5094060.5 -0.9212521 359659.512 408871.9

8 -39634.902 735767.1 30.1741069 55602.506 347075.0

9 276718.757 2815772.4 675.1615559 -30453.297 503872.8

10 -454726.822 2123557.0 -21.3044311 -100935.586 213324.6

y yhat residual CV_Score Stud_residual Intercept_SE AREA_SQM_SE

1 3000000 2886532 113468.16 0 0.38207013 516105.5 823.2860

2 3880000 3466801 413198.52 0 1.01433140 488083.5 825.2380

3 3325000 3616527 -291527.20 0 -0.83780678 963711.4 988.2240

4 4250000 5435482 -1185481.63 0 -2.84614670 444185.5 617.4007

5 1400000 1388166 11834.26 0 0.03404453 2119620.6 1376.2778

6 1320000 1516702 -196701.95 0 -0.72065801 28572883.7 2348.0091

7 3410000 3266881 143118.77 0 0.41291992 679546.6 893.5893

8 1420000 1431955 -11955.27 0 -0.03033109 2217773.1 1415.2604

9 2025000 1832799 192200.83 0 0.52018109 814281.8 943.8434

10 2550000 2223364 326635.53 0 1.10559735 2410252.0 1271.4073

AGE_SE PROX_CBD_SE PROX_CHILDCARE_SE PROX_ELDERLYCARE_SE

1 5889.782 37411.22 319111.1 120633.34

2 6226.916 23615.06 299705.3 84546.69

3 6510.236 56103.77 349128.5 129687.07

4 6010.511 469337.41 304965.2 127150.69

5 8180.361 410644.47 698720.6 327371.55

6 14601.909 5272846.47 1141599.8 1653002.19

7 8970.629 346164.20 530101.1 148598.71

8 8661.309 438035.69 742532.8 399221.05

9 11791.208 89148.35 704630.7 329683.30

10 9941.980 173532.77 500976.2 281876.74

PROX_URA_GROWTH_AREA_SE PROX_MRT_SE PROX_PARK_SE PROX_PRIMARY_SCH_SE

1 56207.39 185181.3 205499.6 152400.7

2 76956.50 281133.9 229358.7 165150.7

3 95774.60 275483.7 314124.3 196662.6

4 470762.12 279877.1 227249.4 240878.9

5 474339.56 363830.0 364580.9 249087.7

6 5496627.21 730453.2 1741712.0 683265.5

7 371692.97 375511.9 297400.9 344602.8

8 517977.91 423155.4 440984.4 261251.2

9 153436.22 285325.4 304998.4 278258.5

10 239182.57 571355.7 599131.8 331284.8

PROX_SHOPPING_MALL_SE PROX_BUS_STOP_SE NO_Of_UNITS_SE FAMILY_FRIENDLY_SE

1 109268.8 600668.6 218.1258 131474.7

2 98906.8 410222.1 208.9410 114989.1

3 119913.3 464156.7 210.9828 146607.2

4 177104.1 562810.8 361.7767 108726.6

5 301032.9 740922.4 299.5034 160663.7

6 2931208.6 1418333.3 602.5571 331727.0

7 249969.5 821236.4 532.1978 129241.2

8 351634.0 775038.4 338.6777 171895.1

9 289872.7 850095.5 439.9037 220223.4

10 265529.7 631399.2 259.0169 189125.5

FREEHOLD_SE Intercept_TV AREA_SQM_TV AGE_TV PROX_CBD_TV

1 115954.0 3.9720784 11.614302 -1.615447 -3.22582173

2 130110.0 3.3460017 20.087361 -9.344188 -6.32792021

3 141031.5 3.5629010 13.247868 -4.102368 -4.62353528

4 138239.1 0.5276150 33.577223 -15.524302 5.17080808

5 210641.1 1.0784029 4.884795 -2.152474 -0.77155660

6 374347.3 -0.1249043 2.572214 -1.817269 0.06207388

7 182216.9 -4.2305303 18.849348 -6.595605 -2.84136028

8 216649.4 0.9189786 4.879056 -2.041481 -0.65080678

9 220473.7 2.1104224 10.150733 -1.221345 1.18682383

10 206346.2 1.4343123 11.068059 -3.176418 -1.35360852

PROX_CHILDCARE_TV PROX_ELDERLYCARE_TV PROX_URA_GROWTH_AREA_TV PROX_MRT_TV

1 1.00048819 -3.2612693 -2.846248368 -1.61864578

2 1.47178634 3.8462625 -1.848971738 -8.92998600

3 -0.34404755 4.1319138 -2.648105057 -3.40075727

4 1.57665606 2.4756745 -5.691404992 -7.28705261

5 0.12990138 -0.4196596 0.640289855 -0.12249416

6 -0.13361179 -0.4237096 -0.005103357 1.00426206

7 -0.33542751 -0.8235874 3.760298131 -7.31116712

8 0.09462126 -0.2405003 0.520038994 -0.03439159

9 -0.93339393 -0.3739225 -2.359121712 -1.67102293

10 0.15961128 1.9461735 -0.627237944 -2.63204802

PROX_PARK_TV PROX_PRIMARY_SCH_TV PROX_SHOPPING_MALL_TV PROX_BUS_STOP_TV

1 -0.83749312 1.5923022 2.75358842 2.0154464

2 2.28192684 6.7019454 -0.88662640 4.4941192

3 0.66565951 2.9058009 -1.05686949 3.0419145

4 -3.34061770 12.9836105 -0.16709578 12.8383775

5 -0.02820944 0.1220998 -0.02488294 0.9145046

6 0.86781794 0.4696245 0.08821750 0.7656963

7 2.38773567 5.1844351 -1.53719231 6.2029165

8 0.16674816 0.2042469 -0.11271635 0.9493299

9 -0.43301073 -0.1442145 0.95462153 3.3123012

10 0.95831249 0.3290120 -1.71252687 3.3632555

NO_Of_UNITS_TV FAMILY_FRIENDLY_TV FREEHOLD_TV Local_R2

1 0.480589953 -0.06902748 2.621347 0.8846744

2 -1.380026395 2.69655779 3.045280 0.8899773

3 -0.045279967 0.04058290 1.197050 0.8947007

4 -0.446007570 14.31276425 8.771149 0.9073605

5 0.141120178 0.36714544 1.557983 0.9510057

6 -0.355762335 0.60891234 1.260522 0.9247586

7 -0.001731033 2.78285441 2.243875 0.8310458

8 0.089093858 0.32346758 1.602012 0.9463936

9 1.534793921 -0.13828365 2.285410 0.8380365

10 -0.082251138 -0.53369623 1.033819 0.9080753

geometry

1 POINT (22085.12 29951.54)

2 POINT (25656.84 34546.2)

3 POINT (23963.99 32890.8)

4 POINT (27044.28 32319.77)

5 POINT (41042.56 33743.64)

6 POINT (39717.04 32943.1)

7 POINT (28419.1 33513.37)

8 POINT (40763.57 33879.61)

9 POINT (23595.63 28884.78)

10 POINT (24586.56 33194.31)gwr.adaptive.output <- as.data.frame(gwr.adaptive$SDF)

condo_resale.sf.adaptive <- cbind(condo_resale.res.sf, as.matrix(gwr.adaptive.output))

We can check the contents using glimpse and

summary:

glimpse(condo_resale.sf.adaptive)Rows: 1,436

Columns: 77

$ POSTCODE <dbl> 118635, 288420, 267833, 258380, 467169, 466472…

$ SELLING_PRICE <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1…

$ AREA_SQM <dbl> 309, 290, 248, 127, 145, 139, 218, 141, 165, 1…

$ AGE <dbl> 30, 32, 33, 7, 28, 22, 24, 24, 27, 31, 17, 22,…

$ PROX_CBD <dbl> 7.941259, 6.609797, 6.898000, 4.038861, 11.783…

$ PROX_CHILDCARE <dbl> 0.16597932, 0.28027246, 0.42922669, 0.39473543…

$ PROX_ELDERLYCARE <dbl> 2.5198118, 1.9333338, 0.5021395, 1.9910316, 1.…

$ PROX_URA_GROWTH_AREA <dbl> 6.618741, 7.505109, 6.463887, 4.906512, 6.4106…

$ PROX_HAWKER_MARKET <dbl> 1.76542207, 0.54507614, 0.37789301, 1.68259969…

$ PROX_KINDERGARTEN <dbl> 0.05835552, 0.61592412, 0.14120309, 0.38200076…

$ PROX_MRT <dbl> 0.5607188, 0.6584461, 0.3053433, 0.6910183, 0.…

$ PROX_PARK <dbl> 1.1710446, 0.1992269, 0.2779886, 0.9832843, 0.…

$ PROX_PRIMARY_SCH <dbl> 1.6340256, 0.9747834, 1.4715016, 1.4546324, 0.…

$ PROX_TOP_PRIMARY_SCH <dbl> 3.3273195, 0.9747834, 1.4715016, 2.3006394, 0.…

$ PROX_SHOPPING_MALL <dbl> 2.2102717, 2.9374279, 1.2256850, 0.3525671, 1.…

$ PROX_SUPERMARKET <dbl> 0.9103958, 0.5900617, 0.4135583, 0.4162219, 0.…

$ PROX_BUS_STOP <dbl> 0.10336166, 0.28673408, 0.28504777, 0.29872340…

$ NO_Of_UNITS <dbl> 18, 20, 27, 30, 30, 31, 32, 32, 32, 32, 34, 34…

$ FAMILY_FRIENDLY <dbl> 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 0, 0, 0, 0…

$ FREEHOLD <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 1, 1…

$ LEASEHOLD_99YR <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ LOG_SELLING_PRICE <dbl> 14.91412, 15.17135, 15.01698, 15.26243, 14.151…

$ MLR_RES <dbl> -1489099.55, 415494.57, 194129.69, 1088992.71,…

$ Intercept <dbl> 2050011.67, 1633128.24, 3433608.17, 234358.91,…

$ AREA_SQM.1 <dbl> 9561.892, 16576.853, 13091.861, 20730.601, 672…

$ AGE.1 <dbl> -9514.634, -58185.479, -26707.386, -93308.988,…

$ PROX_CBD.1 <dbl> -120681.94, -149434.22, -259397.77, 2426853.66…

$ PROX_CHILDCARE.1 <dbl> 319266.925, 441102.177, -120116.816, 480825.28…

$ PROX_ELDERLYCARE.1 <dbl> -393417.795, 325188.741, 535855.806, 314783.72…

$ PROX_URA_GROWTH_AREA.1 <dbl> -159980.203, -142290.389, -253621.206, -267929…

$ PROX_MRT.1 <dbl> -299742.96, -2510522.23, -936853.28, -2039479.…

$ PROX_PARK.1 <dbl> -172104.47, 523379.72, 209099.85, -759153.26, …

$ PROX_PRIMARY_SCH.1 <dbl> 242668.03, 1106830.66, 571462.33, 3127477.21, …

$ PROX_SHOPPING_MALL.1 <dbl> 300881.390, -87693.378, -126732.712, -29593.34…

$ PROX_BUS_STOP.1 <dbl> 1210615.44, 1843587.22, 1411924.90, 7225577.51…

$ NO_Of_UNITS.1 <dbl> 104.8290640, -288.3441183, -9.5532945, -161.35…

$ FAMILY_FRIENDLY.1 <dbl> -9075.370, 310074.664, 5949.746, 1556178.531, …

$ FREEHOLD.1 <dbl> 303955.61, 396221.27, 168821.75, 1212515.58, 3…

$ y <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1…

$ yhat <dbl> 2886531.8, 3466801.5, 3616527.2, 5435481.6, 13…

$ residual <dbl> 113468.16, 413198.52, -291527.20, -1185481.63,…

$ CV_Score <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ Stud_residual <dbl> 0.38207013, 1.01433140, -0.83780678, -2.846146…

$ Intercept_SE <dbl> 516105.5, 488083.5, 963711.4, 444185.5, 211962…

$ AREA_SQM_SE <dbl> 823.2860, 825.2380, 988.2240, 617.4007, 1376.2…

$ AGE_SE <dbl> 5889.782, 6226.916, 6510.236, 6010.511, 8180.3…

$ PROX_CBD_SE <dbl> 37411.22, 23615.06, 56103.77, 469337.41, 41064…

$ PROX_CHILDCARE_SE <dbl> 319111.1, 299705.3, 349128.5, 304965.2, 698720…

$ PROX_ELDERLYCARE_SE <dbl> 120633.34, 84546.69, 129687.07, 127150.69, 327…

$ PROX_URA_GROWTH_AREA_SE <dbl> 56207.39, 76956.50, 95774.60, 470762.12, 47433…

$ PROX_MRT_SE <dbl> 185181.3, 281133.9, 275483.7, 279877.1, 363830…

$ PROX_PARK_SE <dbl> 205499.6, 229358.7, 314124.3, 227249.4, 364580…

$ PROX_PRIMARY_SCH_SE <dbl> 152400.7, 165150.7, 196662.6, 240878.9, 249087…

$ PROX_SHOPPING_MALL_SE <dbl> 109268.8, 98906.8, 119913.3, 177104.1, 301032.…

$ PROX_BUS_STOP_SE <dbl> 600668.6, 410222.1, 464156.7, 562810.8, 740922…

$ NO_Of_UNITS_SE <dbl> 218.1258, 208.9410, 210.9828, 361.7767, 299.50…

$ FAMILY_FRIENDLY_SE <dbl> 131474.73, 114989.07, 146607.22, 108726.62, 16…

$ FREEHOLD_SE <dbl> 115954.0, 130110.0, 141031.5, 138239.1, 210641…

$ Intercept_TV <dbl> 3.9720784, 3.3460017, 3.5629010, 0.5276150, 1.…

$ AREA_SQM_TV <dbl> 11.614302, 20.087361, 13.247868, 33.577223, 4.…

$ AGE_TV <dbl> -1.6154474, -9.3441881, -4.1023685, -15.524301…

$ PROX_CBD_TV <dbl> -3.22582173, -6.32792021, -4.62353528, 5.17080…

$ PROX_CHILDCARE_TV <dbl> 1.000488185, 1.471786337, -0.344047555, 1.5766…

$ PROX_ELDERLYCARE_TV <dbl> -3.26126929, 3.84626245, 4.13191383, 2.4756745…

$ PROX_URA_GROWTH_AREA_TV <dbl> -2.846248368, -1.848971738, -2.648105057, -5.6…

$ PROX_MRT_TV <dbl> -1.61864578, -8.92998600, -3.40075727, -7.2870…

$ PROX_PARK_TV <dbl> -0.83749312, 2.28192684, 0.66565951, -3.340617…

$ PROX_PRIMARY_SCH_TV <dbl> 1.59230221, 6.70194543, 2.90580089, 12.9836104…

$ PROX_SHOPPING_MALL_TV <dbl> 2.753588422, -0.886626400, -1.056869486, -0.16…

$ PROX_BUS_STOP_TV <dbl> 2.0154464, 4.4941192, 3.0419145, 12.8383775, 0…

$ NO_Of_UNITS_TV <dbl> 0.480589953, -1.380026395, -0.045279967, -0.44…

$ FAMILY_FRIENDLY_TV <dbl> -0.06902748, 2.69655779, 0.04058290, 14.312764…

$ FREEHOLD_TV <dbl> 2.6213469, 3.0452799, 1.1970499, 8.7711485, 1.…

$ Local_R2 <dbl> 0.8846744, 0.8899773, 0.8947007, 0.9073605, 0.…

$ coords.x1 <dbl> 22085.12, 25656.84, 23963.99, 27044.28, 41042.…

$ coords.x2 <dbl> 29951.54, 34546.20, 32890.80, 32319.77, 33743.…

$ geometry <POINT [m]> POINT (22085.12 29951.54), POINT (25656.…summary(gwr.adaptive$SDF$yhat) Min. 1st Qu. Median Mean 3rd Qu. Max.

171347 1102001 1385528 1751842 1982307 13887901 10.5 Visualizing Local R2

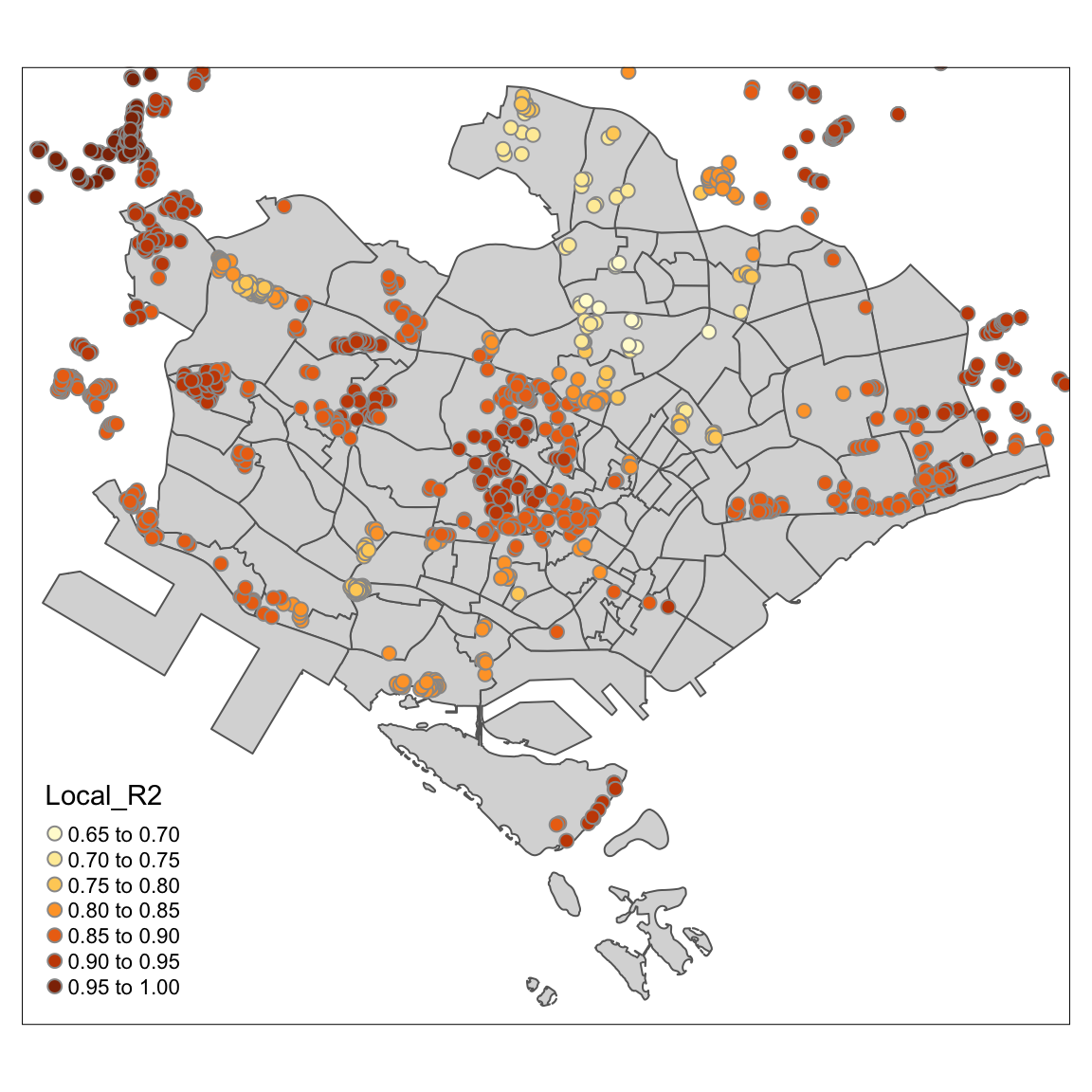

The following code creates an interactive map showing local R2 values:

tmap_mode("view")

tm_shape(mpsz_svy21) +

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "Local_R2", border.col = "gray60", border.lwd = 1) +

tm_view(set.zoom.limits = c(11, 14))tmap_mode("plot")10.6 Visualizing Coefficient Estimates

We can visualize the standard errors and t-values of the

AREA_SQM coefficient using the code below:

tmap_mode("view")

AREA_SQM_SE <- tm_shape(mpsz_svy21) +

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "AREA_SQM_SE", border.col = "gray60", border.lwd = 1) +

tm_view(set.zoom.limits = c(11, 14))

AREA_SQM_TV <- tm_shape(mpsz_svy21) +

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "AREA_SQM_TV", border.col = "gray60", border.lwd = 1) +

tm_view(set.zoom.limits = c(11, 14))

tmap_arrange(AREA_SQM_SE, AREA_SQM_TV, asp = 1, ncol = 2, sync = TRUE)tmap_mode("plot")10.6.1 By URA Planning Region

tm_shape(mpsz_svy21[mpsz_svy21$REGION_N == "CENTRAL REGION", ]) +

tm_polygons() +

tm_shape(condo_resale.sf.adaptive) +

tm_bubbles(col = "Local_R2", size = 0.15, border.col = "gray60", border.lwd = 1)